Do Solar Panels Pay Duty In Zimbabwe?

The use of solar power in Zimbabwe has been growing in recent years, as the country looks to diversify its energy sources and provide electricity access to rural areas. However, the importation of solar panels and equipment comes with duties and taxes that impact the solar industry. This article will examine the import duties applied to solar panels in Zimbabwe, the rationale behind these tariffs, and their effects on solar adoption. The outlook for solar energy and developments around import duties will also be discussed. By providing an overview of the solar import duty situation in Zimbabwe, this article aims to inform about an evolving policy issue impacting renewable energy growth in the country.

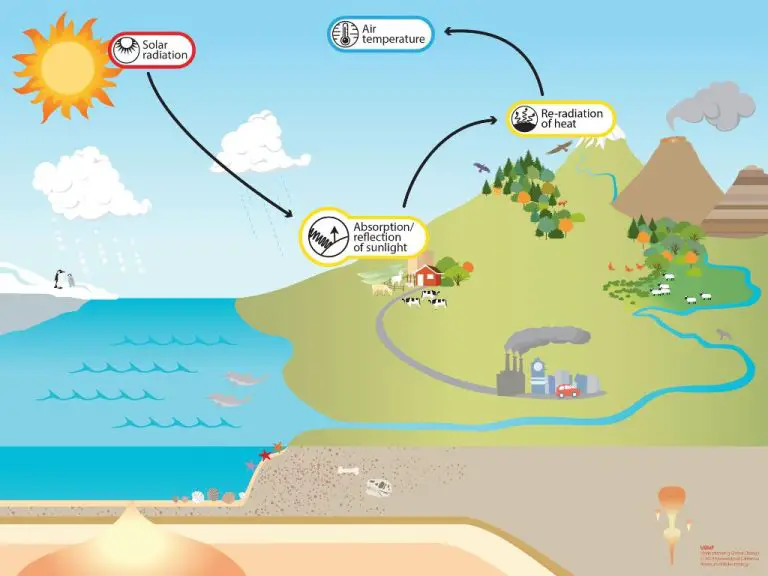

Source:

http://large.stanford.edu/courses/2017/ph240/afshar1/

Background on Solar Power in Zimbabwe

Solar power in Zimbabwe has seen steady growth over the past decade, but still accounts for a small percentage of the country’s overall energy mix. As of 2018, solar contributed around 1% of Zimbabwe’s total installed electricity capacity (Afshar. “Energy Sources and Policy in Zimbabwe.” 2018). However, the country has abundant solar resources with over 3,000 hours of sunshine per year, providing significant potential for expansion.

Most solar adoption has occurred at the residential level, with over 20,000 households using small-scale solar home systems as of 2017 (Chahuruva et al. “Study on Isolated Solar Home Systems for Application in Zimbabwe.” 2017). This has helped provide basic electricity services to rural areas without connection to the national grid. The government has set a target for solar to provide 1,100 MW of capacity by 2025, up from under 50 MW today (Chikodzi. “Potential of Concentrated Solar Power in Zimbabwe.” 2014).

To drive growth, Zimbabwe has implemented policies like tax rebates on solar equipment imports and funding for rural electrification projects. However, the solar industry still faces challenges like high upfront costs, lack of financing mechanisms, and grid integration issues. Overall, solar power represents a promising renewable energy source for Zimbabwe, but greater investment and infrastructure development is needed to unlock its full potential.

Import Duties in Zimbabwe

Import duties are taxes levied on goods imported into Zimbabwe. According to the Zimbabwe Revenue Authority (ZIMRA), there are three main types of import duties charged in Zimbabwe:

- Customs Duty – A tariff or tax imposed on goods entering the country. The rate varies based on the type of product.

- Surtax – An additional duty levied on top of the customs duty. The surtax rate is 25% of the customs duty amount.

- Value Added Tax (VAT) – A type of consumption tax charged at 15% of the customs value of imported goods.

The purpose of import duties is primarily to raise government revenue. But they also serve to protect domestic industries from foreign competition. By making imports more expensive, import duties provide an advantage to locally produced goods.

In Zimbabwe, customs duties are calculated based on the declared customs value and classification of the imported products. Rates are specified in the customs tariff schedule issued by ZIMRA. Surtax is charged at 25% on top of the customs duty amount. And VAT is charged at 15% on the total customs value plus duty and surtax.

All imports into Zimbabwe are subject to payment of applicable duties, taxes and other import fees. The amount payable depends on the tariff classification and origin of the goods. Failure to pay can result in penalties, forfeiture of goods and even criminal charges.

References:

https://www.zimra.co.zw/customs/customs-and-excise-duties

https://www.wto.org/english/res_e/statis_e/daily_update_e/tariff_profiles/zw_e.pdf

Solar Panel Import Duties

Solar panels and related equipment imported into Zimbabwe are subject to import duties and taxes as per the country’s customs regulations. As per the Customs Handbook for Solar PV Products in Zimbabwe published by the African Clean Energy Technical Assistance Facility (ACE-TAF), solar PV panels and certain LED lighting products were granted duty suspension under Statutory Instrument (SI) 147 of 2018

This duty suspension allowed for the importation of specified solar products without paying import duty. However, in July 2019 the government removed this suspension, requiring importers to pay a duty of 40% on solar panels along with 15% VAT and other levies (Reuters, 2019).

The reinstatement of duties was aimed at promoting local solar panel manufacturing and protecting domestic industry. However, stakeholders expressed concerns that this would increase costs and negatively impact solar adoption in Zimbabwe. There are calls for the government to provide exemptions and incentives to support the growth of renewable energy.

Rationale Behind Solar Import Duties

The Zimbabwean government applies import duties and taxes on solar panels and equipment coming into the country in order to generate revenue and protect domestic manufacturers. According to the Customs Handbook for Solar PV Products in Zimbabwe (https://www.ace-taf.org/wp-content/uploads/2021/07/Customs-Handbook-for-Solar-PV-Products-in-Zimbabwe-1.pdf), import duties provide an important source of income for the government and help support local industries and jobs.

Solar panels and related equipment are treated as luxury goods and taxed accordingly in Zimbabwe. The standard rate of duty is 40% for solar panels and associated components like batteries and inverters. The government views solar products as non-essential items that should be taxed at higher rates. Revenue generated from import duties helps fund government operations and programs.

There is also a desire by the Zimbabwean government to promote local manufacturing and protect domestic solar companies from foreign competition. By taxing imported solar equipment at higher rates, the government aims to make locally produced products more price competitive. This incentive encourages the growth of the domestic solar industry. However, critics argue that local manufacturing capabilities are currently limited and that high duties reduce adoption of solar power.

Impact of Duties on Solar Industry

The imposition of import duties on solar panels and related equipment has had a significant impact on Zimbabwe’s solar industry. According to a 2019 Reuters article, import duties of up to 100% had been placed on solar products, making solar power prohibitively expensive for many Zimbabweans.

Since removing these duties in 2019, growth in Zimbabwe’s solar industry has accelerated. A 2023 Context News article cites that solar usage grew from 1MW in 2017 to 20MW in 2022 after duties were lifted. Lower costs have made solar more affordable and led to increased adoption by businesses, homes, and farms.

However, some industry experts argue that more can be done. As cited in an Economic Times article, stakeholders want additional incentives like exemptions on sales tax to further reduce costs. There are also calls to expand net metering policies to allow more renewable energy to be fed into the national grid.

While the removal of import duties marked an important step forward, Zimbabwe’s frequent power shortages mean solar energy is still out of reach for many. Striking a balance between protecting local manufacturers and keeping costs competitive remains an ongoing challenge.

Exemptions and Incentives

The Zimbabwean government has implemented some exemptions and incentives to support the growth of solar power in the country. According to the International Energy Agency, import duty exemptions are given to solar panels, inverters, solar lights, energy saving light bulbs and electricity generators.

In addition, in April 2021, the government announced a 5-year tax exemption for solar energy producers, as reported by SolarQuarter and Afrik21. This tax exemption applies to corporate income tax, customs duty, capital gains tax, and value-added tax on imported capital equipment. The goal is to encourage more investment in solar energy projects in Zimbabwe.

These exemptions and incentives for the solar industry are part of Zimbabwe’s efforts to promote renewable energy and energy access. By removing import duties and providing tax relief, the government aims to accelerate solar power deployment in the country.

Outlook and Developments

In recent years, there have been some positive developments regarding solar duties and regulations in Zimbabwe. In 2019, the government removed import duties on solar-energy-related products like batteries and cables, in an effort to support the growth of solar power (Reuters, 2019).

This removal of import duties helped reduce the costs of solar products and made solar energy more affordable and accessible. It was seen as a much-needed step to boost Zimbabwe’s adoption of renewable energy and improve energy access, especially in rural areas.

Going forward, industry experts predict that solar power will continue to expand in Zimbabwe, aided by government incentives and tax exemptions (IEA, 2022). There are proposals to introduce more exemptions on solar imports, renewable energy equipment, and components for solar projects. This will likely further accelerate growth.

The future outlook for solar energy in Zimbabwe is positive, with solar expected to play an increasing role in the energy mix. Reduced duties and more favorable regulations will help drive higher solar adoption. This will support Zimbabwe’s economic development and energy goals.

Perspectives on Solar Import Duties

There are differing views on whether import duties should be imposed on solar panels and related equipment in Zimbabwe. Proponents argue that duties protect domestic manufacturers and encourage local production (Reuters, 2019). However, others contend that import duties make solar power less affordable and hamper adoption of renewable energy (Journal Record, 2019). Environmental groups believe duties should be removed to incentivize clean energy and support climate goals.

The solar industry argues that duties increase costs for solar projects and hurt job creation in the renewable sector. But some policymakers want to nurture domestic manufacturing through protectionist measures. Workers in the solar manufacturing sector support duties to prevent foreign competition. Consumers want affordable access to solar power to cope with electricity shortages.

There are reasonable arguments on both sides of this issue. The Zimbabwean government must balance competing interests and priorities in determining the appropriate policy on solar equipment duties. Reduced duties can accelerate solar adoption but may undermine local manufacturers. It is a complex debate with valid perspectives on different sides.

Conclusion

To summarize, solar panels imported into Zimbabwe are subject to import duties. The government levies duties on imported solar panels and components to protect domestic manufacturers and raise revenue. The standard import duty rate is 40% for solar panels and associated parts.

While duties make imported solar equipment more expensive, the government has put in place exemptions and incentives like tax rebates for solar projects. The high duties have impacted the solar industry in Zimbabwe by slowing adoption. But projects for rural electrification and net metering have continued to expand despite the tariffs.

Perspectives are mixed on whether the current rates strike the right balance between supporting local production and adopting more renewable energy. With solar power holding great potential in the sunny climate, stakeholders hope import duties will be optimized to account for socioeconomic and environmental factors. But for now, those importing solar panels into Zimbabwe should expect to pay import duties.

In conclusion, Zimbabwe has applied import duties to solar panels to balance multiple economic objectives. This has resulted in increased prices but initiatives remain in place to incentivize solar energy adoption. Ongoing developments should continue to shape the country’s approach to solar power access and affordability through strategic trade policy.