Are Solar Panels In Ohio Worth It?

Solar power is growing rapidly in Ohio. In recent years, Ohio has emerged as a top state for solar energy, ranking 9th nationwide for planned solar projects. While solar only accounted for about 1% of Ohio’s electricity generation in 2021, adoption continues to increase each year. With declining costs and new incentives, many Ohio homeowners are now considering installing solar panels. But the big question is – are solar panels actually worth the investment for Ohio homes? This article examines the costs, incentives, savings, and other factors to determine if solar panels make sense financially in Ohio.

Cost of Solar Panels in Ohio

According to [Source 1], the average cost to purchase and install solar panels in Ohio as of January 2024 is around $2.70 per watt. For a typical 5 kW residential system, the total cost comes out to around $13,500 before incentives.

The main factors that influence the cost of solar panels in Ohio include:

- System size – Larger solar panel systems typically cost less per watt due to economies of scale.

- Permits and fees – Building permits, inspections, and interconnection fees can add several hundred dollars.

- Roof type – Installations on tile, slate, or metal roofs are more complex and costly.

- Location – Prices are higher in some metro areas like Cleveland and Cincinnati.

- Panel efficiency – High-efficiency panels produce more energy but have a higher upfront cost.

It’s important to get multiple quotes from reputable local installers, as prices can vary significantly. Be sure to take advantage of all available incentives and rebates in Ohio to reduce the overall cost.

Solar Panel Incentives and Rebates in Ohio

Ohio offers several incentives and rebates to make solar panels more affordable for homeowners. The two main programs are:

Net Metering – Net metering allows solar panel owners to get credit for excess electricity they send back to the grid. This credit can be used to offset electricity usage during nighttime hours. Net metering ensures solar owners receive fair compensation for power generation (Source).

Renewable Energy Credit (REC) Program – Ohio has a solar renewable energy credit (SREC) program where solar panel owners earn certificates for every 1,000 kWh produced. SRECs can then be sold on the open market to utility companies to meet their renewable energy requirements. Prices fluctuate but SRECs in Ohio typically sell for $50-150 each (Source).

Together, net metering and SRECs help offset the cost of a solar array in Ohio by several thousand dollars. Exact savings depend on system size, electricity usage, and the local utility’s net metering policy.

Electricity Bill Savings

The average residential electricity rate in Ohio is around 15¢ per kWh, which is lower than the national average of 18¢ per kWh according to Energysage. However, electricity rates in Ohio have been steadily rising over the past decade. Installing solar panels allows homeowners to reduce and stabilize their electricity costs.

Most solar panel systems in Ohio produce around 1,200 kWh of electricity per kW of installed solar capacity. For example, a 5 kW solar system would produce around 6,000 kWh annually. With the average electricity rate of 15¢/kWh in Ohio, this solar system could save a homeowner around $900 per year on their electricity bill.

Exact savings depends on system size, electricity usage, and local electricity rates. But most sources estimate solar panel systems provide 40-60% reduction on electricity bills for an average home in Ohio. This consistent savings over 20-30 years can really add up for homeowners in the state.

Federal Solar Tax Credits

The federal government offers a tax credit known as the Investment Tax Credit (ITC) to encourage homeowners to install solar panel systems. This tax credit allows homeowners to deduct 26% of the cost of installing a solar system from their federal taxes in 2022. The ITC will step down to 22% in 2023 before expiring completely for residential projects in 2024 (Homeowner’s Guide to the Federal Tax Credit).

For example, if you install a $15,000 solar panel system in 2022, you can deduct 26% or $3,900 from your federal taxes that year. This helps offset the upfront costs of going solar. The ITC can be combined with other incentives like state/local rebates and net metering savings. It’s one of the most valuable incentives for residential solar nationwide (Residential Clean Energy Credit).

Payback Period in Ohio

The payback period for solar panels in Ohio is around 10-12 years according to recent analysis (see https://www.energysage.com/solar-panels/oh/). This refers to the amount of time it takes to recoup the upfront costs of installing a solar panel system through energy savings. The main factors that influence the payback period are:

- System size – Larger solar installations cost more upfront but produce greater long-term savings.

- Electricity costs – The higher the local electricity rates, the faster the payback period.

- Solar incentives – Rebates and tax credits reduce net costs, shortening the payback period.

- Panel efficiency – More efficient solar panels generate more energy over their lifetime.

- Geographic location – Sunnier climates increase solar energy production.

Ohio’s payback period is slightly longer than sunnier states, but still makes financial sense for most homeowners with high electricity bills. The average payback period is faster than the 25-year lifetime of a solar system. With incentives and rebates, solar panels in Ohio can pay for themselves in under 10 years.

Impact on Home Value

Installing solar panels can significantly increase a home’s value in Ohio. According to a study by Zillow, solar installations increase a home’s resale value by up to $5,911 for each kilowatt of solar panels installed. Another study concluded that home value increases by $20 for every $1 reduction in yearly utility bills from solar panels.

For a typical 5 kilowatt solar array in Ohio, that could mean over $29,000 in added home value. With high electricity rates in the state, solar panels can reduce utility bills significantly, leading to thousands in added resale value. Overall, homes with solar panels in Ohio sell for around 4% more than comparable homes without solar.

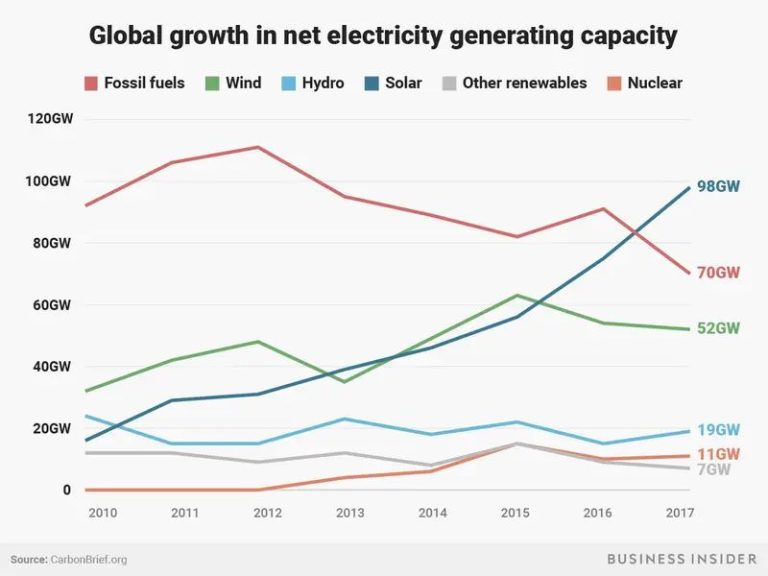

Environmental Benefits of Solar Panels in Ohio

Installing solar panels in Ohio provides significant environmental benefits by reducing carbon emissions and moving the state toward cleaner energy sources. According to research from the National Renewable Energy Laboratory, a typical 5kW solar array in Ohio reduces lifetime carbon emissions by over 52 metric tons – equivalent to avoiding driving a car for over 130,000 miles. With over 21,000 solar installations across the state already, solar power in Ohio is estimated to offset carbon emissions by 364,000 metric tons per year.

As one of the top coal-producing states, Ohio has faced environmental challenges from relying heavily on fossil fuels. In recent years, growth in renewable energy is helping change that trajectory. The solar industry employs over 7,000 workers in Ohio and continues expanding as costs fall. Converting more homes, businesses, and utilities to solar power will further reduce Ohio’s carbon footprint and provide cleaner air and water for local communities.

Maintenance and Durability

Solar panels typically require very little maintenance. There are no moving parts, so they tend not to break down or require repairs often. However, some periodic maintenance is recommended to keep panels operating efficiently.

Maintenance usually involves inspecting the panels and connections for damage, cleaning dust and dirt off the panels with water and a soft brush or cloth, and trimming any overgrown vegetation that may be shading the panels. Most solar companies recommend having panels professionally inspected and cleaned once a year. The cost for annual maintenance in Ohio averages $150-250 per visit.

Solar panels are very durable and built to withstand the elements. Manufacturers typically warranty panels to produce 80% of their original output for 25 years. However, panels can last even longer than that. One 30-year study on solar panel degradation in Ohio found an average annual degradation rate of only 0.5%, meaning even after 30 years, panels retained 84% of their original output [1]. Keeping panels clean and well-maintained helps minimize degradation over time.

Overall, solar panels are low maintenance investments that can last 30 years or more in Ohio’s climate with proper care. Annual inspections and cleanings are recommended to maximize solar production.

Conclusion

In summary, the costs for solar panels in Ohio range from $10,000 to $25,000 for an average 6kW system. However, there are several incentives and rebates available to help reduce the upfront costs, including the federal solar tax credit which covers 26% of installation costs. Over the lifetime of the system, homeowners can expect to save thousands in electricity costs. The payback period averages around 6-8 years. Beyond financial savings, solar panels can increase home value, reduce environmental impact, and provide years of free electricity after payback.

Given the significant electricity bill savings, short payback period, environmental benefits, and the various incentives available, solar panels are definitely worth it for most homeowners in Ohio. With electricity prices continuing to rise, and solar incentives in place, now is a great time to go solar.