Are Solar Panel Payments Tax Deductible?

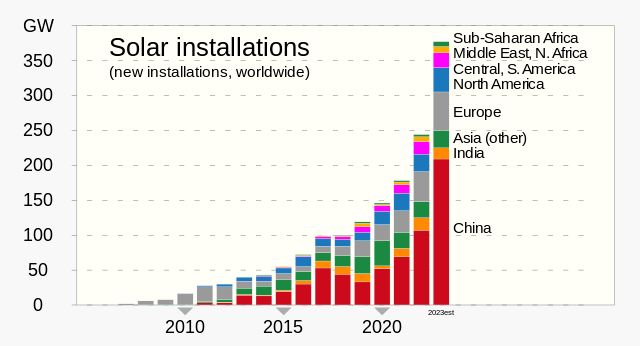

Solar panels are devices that convert sunlight into electricity. As the use of solar power has grown rapidly in recent years, many homeowners have installed solar panels on their properties. This raises an important question – are payments and expenses related to solar panels tax deductible? This article will provide a comprehensive overview of the available federal and state tax deductions for solar panels. We’ll cover the key tax credits, deductions for interest paid on solar loans, operational costs, and depreciation of solar equipment. Understanding the tax benefits can help homeowners decide if installing solar panels makes financial sense for their situation. The purpose of this article is to inform homeowners about the potential tax savings available for switching to solar power.

What are Solar Panels?

Solar panels, also known as photovoltaic (PV) panels, are devices that convert sunlight into electricity using the photovoltaic effect. According to National Grid, solar panels are made up of many solar cells containing a silicon semiconductor material that absorbs photons from sunlight and converts them into electrons. The electrons create an electric current that flows from the solar panels into an inverter, which converts the direct current (DC) into alternating current (AC) used to power homes and businesses.

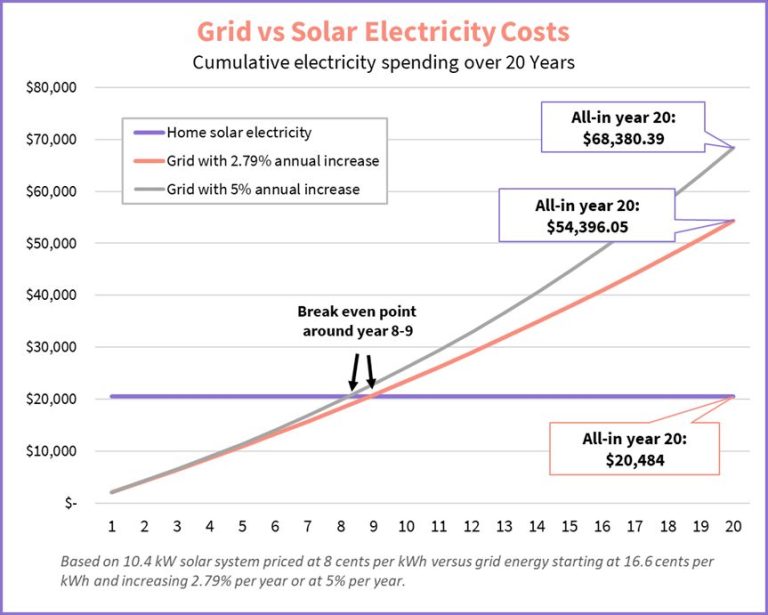

According to the Department of Energy, solar panels can be installed on rooftops or ground-mounted systems to maximize sunlight exposure. They require very little maintenance and have lifespans of 20-30 years. The main costs of installing solar panels include the purchase of the panels, inverters, racking and mounting equipment. Additional costs include permits, installation labor, and maintenance. The main benefits are reduced electricity bills over the long term and lower carbon emissions compared to fossil fuel energy sources.

What Tax Deductions Are Available for Homeowners?

Homeowners can take advantage of several valuable tax deductions that can help lower their taxable income each year. Some of the most common homeowner tax deductions include:

- Mortgage interest – Interest paid on a primary residence and second homes is typically tax deductible up to certain limits (https://www.nerdwallet.com/article/mortgages/tax-deductions-for-homeowners).

- Property taxes – State and local property taxes on a primary residence can be deducted without limit (https://www.cnbc.com/select/tax-deductions-for-homeowners/).

- Points paid on a home loan – Points paid at closing for a mortgage can be deducted over the life of the loan.

- Home equity loan/line of credit interest – Interest paid on home equity debt up to $100,000 can be deducted.

- Home office expenses – If you use part of your home regularly for business, related expenses like utilities can be deducted.

- Home improvements – Certain home improvements like energy efficiency upgrades may qualify for tax credits.

Taking advantage of these homeowner deductions each year can lead to substantial tax savings. Homeowners should be sure to track deductible expenses like mortgage interest and property taxes when filing their returns.

Tax Credits vs. Deductions

Tax credits and deductions both lower your tax bill, but they operate in different ways (Source 1). A tax deduction reduces your taxable income. For example, if you are in the 22% tax bracket, a $1,000 deduction saves you $220 in taxes. A tax credit directly reduces the amount of tax you owe dollar-for-dollar. A $1,000 tax credit saves you $1,000 on your tax bill regardless of your tax bracket.

With a tax deduction, the actual savings depends on your tax bracket. Higher income earners in higher brackets get bigger savings from the same deduction amount. A tax credit provides the same amount of savings to all taxpayers regardless of income and tax bracket (Source 2).

In summary, deductions reduce taxable income while credits reduce the actual amount of tax owed. Credits provide more savings overall, especially for lower-income taxpayers. Both can help reduce your tax liability in different ways.

Federal Solar Panel Tax Credits

The federal government offers a tax credit to homeowners who install solar photovoltaic systems on their homes. The federal residential solar tax credit allows homeowners to claim a credit for 26% of the cost of installing a solar system on their home. For systems installed in 2022, the maximum credit amount is $8,000. This means for a system that costs $30,000 to install, the maximum credit would be $7,800 (26% of $30,000).

To qualify for the full 26% tax credit, the solar PV system must be installed and placed in service by December 31, 2022. The credit percentage is scheduled to decrease to 22% for systems installed in 2023. After 2023, the residential solar tax credit will be eliminated for homeowners, while a permanent 10% credit will remain in place for commercial solar installations.

There is no income limit to claim the federal solar tax credit. Any homeowner who installs a qualifying solar energy system on their primary residence or secondary home is eligible. The home must be located in the United States.

The solar panels must be new equipment that provides electricity for a dwelling unit. Purchased panels that are not yet installed do not qualify. The homeowner must own the solar system to claim the tax credit. Leased solar panel systems are not eligible.

State Solar Panel Tax Credits

In addition to the federal solar tax credit, many states offer their own incentives to go solar in the form of rebates, tax credits, or performance-based incentives. State-level incentives can significantly reduce the cost of installing a solar energy system.

For example, California offers a solar tax credit called the California Solar Initiative (CSI) Thermal Program that provides rebates of up to $25 per therm of annual expected system output for solar water heating systems installed on residential and commercial properties. According to the U.S. Department of Energy, this incentive in California can cover up to 40% of the total system costs.

Other states like New York, Massachusetts, and New Jersey also offer robust solar incentives in the form of tax credits up to $5,000 or performance-based incentives of $1/Watt installed. Checking a state’s specific solar policies is recommended, as incentives can make solar power very affordable.

Interest Paid on Solar Loans

Interest paid on solar loans can potentially be tax deductible, similar to mortgage interest deductions. However, there are some important limitations to be aware of.

If you take out a solar loan specifically for the purchase and installation of a solar panel system, the interest paid can be claimed as an itemized deduction on your tax return. This applies to loans from banks, credit unions, or other standard lending institutions. The loan must be secured by the solar panels or your home. The IRS considers this a “home equity loan” since it is secured against your home’s equity.

However, the deductible amount has limits. You can only deduct interest on solar loans up to $100,000 for a married couple filing jointly, and up to $50,000 for a single filer. The loan amount over that limit cannot be deducted.

Additionally, if you refinance your mortgage and roll the solar loan into it, you can no longer deduct the solar loan interest specifically. It gets lumped in with the overall mortgage interest.

So in summary, interest on a solar-specific loan below the $100k/$50k limits can be deductible, but with limitations. Consult a tax professional to understand how it applies to your specific situation.

Operational Costs

In addition to the initial costs of purchasing and installing solar panels, homeowners may be able to deduct some of the ongoing operational costs related to their solar energy system.

Maintenance costs like cleaning the solar panels, inverter repairs, and replacing any broken equipment are potentially tax deductible. However, the solar tax credit does not apply to these maintenance expenses (Solar Optimum).

To deduct maintenance costs, homeowners need to itemize their deductions and the costs must be considered ordinary and necessary. The IRS may request detailed records showing that the maintenance expenses were directly related to the operation of the solar energy system.

In addition to maintenance, the interest paid on a solar loan can also be tax deductible. Homeowners who take out a loan to finance their solar panel system can deduct the interest paid as an itemized deduction on Schedule A (DOE). This provides an extra tax benefit on top of the solar tax credit.

While operational costs like maintenance and interest may be deductible, utilities and other ongoing costs of running the solar energy system are generally not deductible expenses.

Depreciation of Solar Equipment

Businesses that install solar panels or other solar energy equipment can depreciate these costs over time to reduce their taxable income. This allows them to deduct a portion of the solar equipment costs each year. The depreciation schedule depends on the classification of the solar energy property.

Most solar equipment qualifies for a 5-year depreciation schedule under the Modified Accelerated Cost Recovery System (MACRS). This allows businesses to deduct 85% of the initial solar investment over 5 years: 20% in the first year, 32% in the second year, 19.2% in the third year, 11.52% in the fourth year, and 11.52% in the fifth year (SEIA).

Speeding up the depreciation schedule to 5 years, compared to longer schedules for other equipment, helps improve the return on investment for solar installations. The accelerated depreciation provides valuable tax deductions in the early years of a solar project when they have the greatest financial impact.

In addition, most solar equipment qualifies for bonus depreciation, allowing businesses to deduct 60% of the cost in the first year. The remaining 40% qualifies for regular depreciation under MACRS (The Tax Adviser).

Together, the 5-year MACRS schedule and bonus depreciation provide significant tax deductions for businesses investing in solar power. This tax benefit improves ROI and payback period, making solar energy more financially attractive.

Conclusions

Installing solar panels on your home is a significant investment that provides various tax deductions. Depending on your specific circumstances and location, you may qualify for state or federal solar panel tax credits that directly lower your tax bill for up to 30% of the costs.

The interest paid on a solar loan or equipment lease is typically deductible, similar to mortgage interest on a home. Delays in claiming the tax credits may allow you to deduct more interest.

You can also deduct operational costs like maintenance, repairs, and insurance for the solar system. The equipment itself can be depreciated over five years to lower your taxable income. Analyzing the time value of these deductions can make solar power even more affordable.

When considering solar for your home, be sure to consult a tax professional to maximize deductions and credits based on your situation. Proper planning and timing of claims can substantially reduce the after-tax costs of your solar panel investment.